520

Views & Citations10

Likes & Shares

Wage determination has been a topic of debate for over two hundred years, with numerous studies attempting to solve this issue but failing to reach a consensus (Dunlop & Segrave, 2016). Considering prior Islamic research, the Quran and Sunnah and Shia Fiqh suggest that wages should be split into a fixed wage that covers basic expenses for survival and a variable wage that covers other variable factors such as education, experience, productivity, and so on (Acharya, 2017). This approach ensures that workers receive a fair wage that is commensurate with their skills and experience while also ensuring that they can meet their basic needs. The Shia sect views also emphasize the importance of fair and ethical wage determination practices. Incorporating the principles of social welfare, equity, and the distribution of wealth found in Islamic literature is crucial to ensure fairness and justice in wage determination (Ali & Rahim, 2019; Ahmed, Siddiqui, & Ahmed, 2021; Hasan & Alam, 2019). Despite ongoing research and debate, economists have yet to find a formula that can resolve the conflict between employers and employees regarding fair regulation of wages (Cantillo et al., 2022). The complexity of the labor market and the various factors that determine and influence wages beyond the supply and demand of labor have led to economic and social problems, as the recommended general wage determination methods, efficiency wage, and minimum wage criteria are not fair or ethical (Acharya, 2017).

In sum, the complexity and segmentation of the labor market have revealed that current wage determination theories do not accurately reflect the reality of the market. Splitting wages into a fixed and variable component, as suggested by the Quran and Sunnah and Shia Fiqh, may provide a fair and ethical solution to the issue of wage determination in the current era. This study recommends sorted variables from Islamic literature to list under fixed and variable wages that not only match with the real world but also human psychology. Empirical studies based on the need for the study revealed by these conceptual papers are necessary to confirm whether the suggested variable works across cultures. The present study contributes socially, economically, and politically to the ongoing debate on wage determination.

METHOD

Search Strategy

In June 2021, the present study systematically searched for original scholarly papers published before 1955 in major databases such as PubMed/Medline, PsychInfo, SportDiscus, and Embase. Phrases and their alternatives used to recognize relevant scholarly papers included: wage theories, wage model, labor supply, labor demand, etc. The term codes were: [(wage*) OR (salary*)) OR (OR (earning*) AND ((LS*) OR (LD) OR (efficiency wage) OR (monetary reward))]. Titles and abstracts were scrutinized to pre-eliminate articles that did not match with the criteria. Full texts of the leftover scholarly papers were found and then scrutinized by two independent reviewers to meet eligibility criteria. Cohen’s kappa (Cohen 1960) suggested an index between reviewers of agreement. lists of references consist of articles that were examined to complete the search.

SELECTION CRITERIA

Types of Studies

This study considered the scholarly papers published in English-language journals and Arabic Language Journals and books were considered for inclusion. Arabic language Journals and books were mainly required to consider because of driving Islamic perspective to cope with the ongoing challenges to determine wages. The review included both observational studies (cross-sectional and longitudinal) and intervention was reported as an index of agreement between reviewers. Reference lists of included articles were further examined to complete the search. Unpublished abstracts, articles, and these were excluded.

Participants

Since one goal of this review was to identify such variables which are recommended to be considered to determine the wage so population and case studies across the world were included in the review.

Outcome Measures

The selected studies or inclusion necessary to have a particular assessment for an individual’s wage. Sch papers whose assessment tools were primarily designed for wage fixing, but later unemployment was excluded. Additionally, observational studies and intervention studies were included in the literature of this study, all studies are contained which obviously report the relationships between different factors’ effects on wage determination.

Data Extraction

The following information was independently extracted and abstracted by two reviewers using a structured template: author details, year of publication; Study type, characteristics of participants, and location of the country, which help determine outcomes and key findings. Criticisms of traditional theories and challenges in today's wage setting are addressed through discussions of reviewers and Islamic literature. No attempt was made to contact the authors of the included articles for missing information.

RESULTS

Search Results

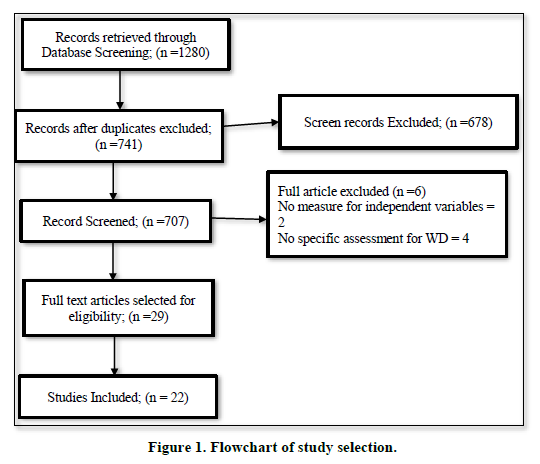

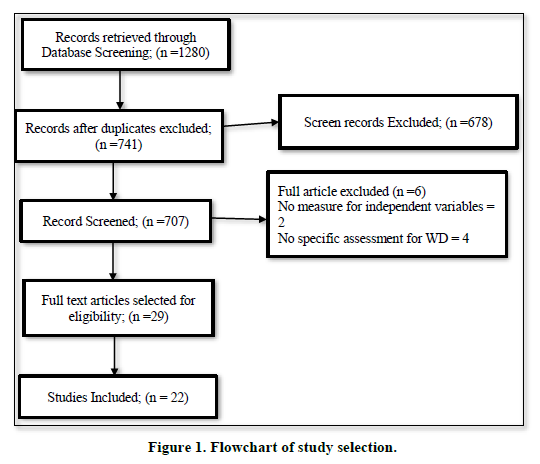

A systematic search initially found a total of 1142 studies. After removing duplicates, 741 duplicates were identified for the screening step. The process of enrolling studies is shown in Figure 1. After reviewing the title and abstracts, 29 studies were deemed potentially eligible for inclusion. For these studies, full-text articles were retrieved and screened for eligibility, with 23 studies ultimately accepted for inclusion. There were no specific measures of fixed and variable factors that determine wages, no specific measure of WD or other constructs in the root causes of exclusion. Cohen's kappa was 0.89, indicating high agreement between raters according to the criteria proposed by Cohen (1960).

Characteristics of Included Studies

Of the 23 studies, fifteen were observational and eight were intervention studies. Except for two articles from 2000, the rest of the included articles were published after 2007. Even theories prior published were discussed after 2007 were considered. The included studies were conducted across the world. Hence the gap of conventional prior studies on WD is discussed and these gaps are filled by Islamic literature directions. Hence few studies like theories published.

LITERATURE REVIEW

Conventional Theories and Criticism

In the field of economics, various theories regarding wage determination have gained popularity. One such theory is the Wage fund theory developed by Adam Smith in (1723-1790). This theory suggests that the wage rate is determined by dividing the wage fund by the number of laborers, but it ignores important issues such as the method of estimating the sources of wages (Hülsmann, 2018). Boianovsky, M. (2019) argues that the quality and efficiency of the worker are ignored when determining the wage rate. This study assumes that wages can be increased at the expense of profits, but this violates the law of increasing returns, which states that an increase in total output can increase profits. Karl Marx (1849-1883) proposed the Surplus Value Theory, stating that labor is an article that can be purchased by paying wages. However, Marxism has its own critique of the ideology that seeks to exploit the working class through capitalism. Walker (1840-1897) identifies four factors of production: land, labor, capital, and enterprise. When these three factors are rewarded, the one who survives gets the wages. This research assumes that landowners, capitalists, and traders have their share fixed, but this is entirely wrong. The supply side of labor is entirely ignored by the theory.

Subsistence theory was proposed by David Ricardo (1772-1823), which suggests that wages should be fixed at the minimum subsistence level. This theory has been criticized for ignoring the demand side, wage differences, and the role of unions in wage determination (Bohrer, 2022). Labor search theory proposes that the entire wage distribution should lie below the marginal product of labor, replicating the phenomenon of minimum wage without negatively affecting employment (Azid et al., 2022). Marginal productivity theory, developed by Phillips Henry and J.B. Clark in 1826, states that wages should be based on the productivity of labor. However, this theory has been criticized for ignoring the supply side and wage differences (Okishio, 2022). The discounted marginal productivity theory, a revised version of marginal productivity theory, suggests that workers' wages are determined by the discounted marginal product, as production is a long process (Boianovsky, 2019). The modern theory of wages proposes that wages are the price of services rendered by labor to the employer and should be fixed based on labor demand and supply (Cantillo et al., 2022). Bargaining theory, developed by John Davidson in 1999, suggests that wages should be fixed through the power of bargaining between employees and employers. The stronger the bargaining power of labor, the higher the wage rate (Ehrenberg, Smith & Hallock, 2021). Behavior theory, based on previous studies on wage determination, suggests that the acceptance of wage levels by employees determines the wage rate (Gahan & Harcourt, 1998). However, this theory has been criticized for its failure to account for other factors that influence wage determination.

The second part of this section discusses the prior conventional empirical studies on wage determination. In conventional economics, the minimum wage has proven to be a paradox, as its impact varies greatly among countries. Neumark & Wascher (1999) used time-series data of OECD countries for the period 1975-1997 and revealed that the influence of the minimum wage on employment varies considerably among countries (Belman & Wolfson, 2016; Betcherman, 2014). and the International Labor Organization (ILO) (2019) found that the impact of the minimum wage on employment is often debatable, and economic theories have different projections.

Complexities of On-Ground Reality Markets and Their Impact on Wage Determination

The complexities of on-ground reality markets and their impact on wage determination have been extensively discussed in the literature. Empirical studies have revealed that the conventional theories of wage determination, which assume that the market operates on the principles of supply and demand, fail to consider the complexities of the real-world labor market. For example, Acharya, (2017) argued that the labor market is segmented and complex, and there are many other factors beyond the supply and demand of labor that influence wages. Similarly, a study by Doucouliagos and Stanley (2009) examined the impact of minimum wages on employment and found a minor to zero impact of minimum wage on employment. The study suggests that policymakers should formulate policies based on the literature findings on price changes' impact on other variables of aggregate demand, such as investment, household expenditures, or the competitiveness of exports.

Another study by Broecke, Forti, and Vandeweyer, (2015) conducted a meta-analysis of 74 empirical studies on the influence of minimum wages on employment in developing countries. The study found that minimum wage has no effect or minimal effect on employment. However, the study also notes that the impact of minimum wage varies depending on the country and the context.

Moreover, studies have shown that the conventional wage determination methods, such as minimum wage and efficiency wage, have led to numerous problems, including income inequality, poverty, gender pay gaps, social crime, and unemployment (Kim & Lim, 2018; Neumark & Wascher, 2007). The implications of these problems are not only limited to the individual worker but also have broader social and economic consequences, such as reduced productivity, increased poverty, and social unrest. Suryahadi et al. (2008) found that social norms and cultural practices significantly influence wage levels, even after controlling for human capital factors. Research suggests that on-ground reality markets are often segmented, meaning that different sectors of the labor market may have different wage determination mechanisms (Gindling &Terrell, 2010). This segmentation is often based on factors such as education, experience, gender, and ethnicity, and can result in unequal pay and discrimination in the labor market. Another factor that affects wage determination in on-ground reality markets is the presence of non-market forces, such as government regulations, labor laws, and labor unions. For example, in their study on the impact of minimum wage on employment in the United States, Allegretto, (2011) found that minimum wage laws can have different effects depending on the characteristics of the labor market and the presence of labor unions.

Furthermore, the informal economy, which is a significant part of on-ground reality markets, poses challenges to wage determination. Informal workers are often not covered by labor laws and regulations, and their wages are determined through informal bargaining and negotiation (Chen et al., 2005). This informal wage determination process can result in low pay and exploitation of workers.

Islamic literature provides an alternative perspective on wage determination that considers the complexities of on-ground reality markets. According to Islamic literature, the total offered wage rate should be divided into fixed and variable components, where the fixed component covers basic expenditure for survival, and the variable component covers education, experience, and productivity (Khan, 2020). Islamic literature also emphasizes the importance of social welfare and encourages the distribution of wealth through Zakat and other forms of charity. By integrating conventional and Islamic views on wage determination, a unified and ethical wage determination criterion can be developed that considers the complexities of on-ground reality markets and promotes fairness, justice, and sustainability. Such a system would lead to increased productivity, reduced poverty and inequality, and improved social and economic outcomes. However, empirical studies are needed to confirm whether the suggested variables work across different cultures and markets.

Influential Factors Beyond the Supply and Demand of Labor, Custom, and Culture

The determination of wages is a complex process that is influenced by several factors beyond the supply and demand of labor, custom, and culture. These factors include social, economic, and political variables, which affect wage determination in different ways. This literature review will discuss the influential factors beyond the supply and demand of labor, custom, and culture that impact wage determination. One of the factors that affect wage determination is globalization. As trade barriers have decreased, the competition between firms has increased, which has led to a shift in the labor market. This shift has affected wage determination in developed countries, as firms have sought to lower their labor costs by moving production to countries with lower wages (Bhagwati, 2004). The globalization process has also led to the outsourcing of jobs to countries with lower wages, which has further reduced the bargaining power of workers in developed countries (Rodrik, 2018).

Another factor that influences wage determination is technological change. Technological advancements have led to the automation of many jobs, which has reduced the demand for labor in certain industries (Brynjolfsson & McAfee, (2014). This has led to a decline in wages for workers in those industries and has increased the wage gap between workers with different levels of education and skills (Autor, 2014). The political environment is another important factor that affects wage determination. Changes in government policies can have a significant impact on wages. For example, changes in tax policies, minimum wage laws, and labor regulations can all affect the bargaining power of workers and the wages they receive (Mishel, Gould, & Bivens, 2012). Political instability, corruption, and weak institutions can also have a negative impact on wages by creating uncertainty in the labor market (Kucera, Roncolato, & von Uexkull, 2017). Gender and ethnicity are also influential factors that affect wage determination. Women and ethnic minorities often face discrimination in the labor market, which results in lower wages (Blau & Kahn, 2017). This discrimination can be based on factors such as educational attainment, work experience, and job type (Budig & England, 2001). Discrimination can also occur in the hiring process, as employers may prefer certain types of workers over others (Pager & Shepherd, 2008).

One significant factor that influences wage determination is education and training. Studies have shown that education and training play a crucial role in determining wages, especially in developed countries. For instance, Aina & Nabbout, (2014) found that education and training have a positive effect on wages in Nigeria. Similarly, Blomquist & Newmark, (2016) showed that individuals with higher levels of education and training in the United States have higher wages compared to those with lower levels of education and training. Another important factor that affects wage determination is discrimination based on gender, race, ethnicity, and other social categories. Numerous studies have demonstrated that discrimination results in wage disparities and lower wages for certain groups. For instance, Blau & Kahn, (2017) showed that there is a significant gender pay gap in the United States. Similarly, Blackaby, (2011) found that ethnic minorities in the UK are paid less than their white counterparts.

The geographic location of workers also plays a crucial role in wage determination. In many countries, there are significant wage differences between rural and urban areas. Studies have shown that wages are generally higher in urban areas due to higher levels of economic activity and demand for labor. For instance, Arslan, (2015) found that wages are generally higher in urban areas in Turkey compared to rural areas. In addition to these factors, labor market institutions such as unions, minimum wage laws, and employment protection legislation can also have a significant impact on wage determination. For instance, Bhaskar, (2016) found that minimum wage laws in the UK have a positive effect on wages. Similarly, Fernández-Kranz & Rodríguez-Planas, (2013) showed that employment protection legislation in Spain leads to higher wages for permanent workers.

Overall, wage determination is a complex process that is influenced by numerous factors beyond the basic principles of supply and demand. Education and training, discrimination, geographic location, and labor market institutions are just a few examples of these influential factors. A comprehensive understanding of these factors is essential for developing a fair and just wage system that ensures sustainability, social welfare, and economic growth.

Impact of General Wage Determination Methods on Social, Economic, and Political Outcomes

General wage determination methods, efficiency wage, and minimum wage criteria have been widely used in wage determination. However, the impact of these methods on social, economic, and political outcomes has been subject to debate and criticism. Some studies suggest that the implementation of minimum wage criteria can lead to negative effects on employment and job opportunities, particularly for low-skilled workers (Dube et al., 2010; Allegretto et al., 2011; Giuliano, 2012; Kertesi & Kollo, 2003; Metcalf, 2008; Kim & Jang, 2020; Neumark & Wascher, 2007; Neumark & Wascher, 1999). Similarly, efficiency wage criteria have been criticized for creating a "wage-led" economy that could result in increased income inequality and poverty (Mankiw, 2019).

Moreover, the use of general wage determination methods has been linked to various social and political outcomes. For instance, studies have shown that wage inequality can lead to social unrest and increased crime rates (Chen & Zhang, 2018; Kelley, 2018). In addition, the negative impact of minimum wage criteria on employment can lead to increased poverty rates and decreased economic growth (Noland et al., 2018). On the other hand, proponents of general wage determination methods argue that they are essential for ensuring social welfare and reducing income inequality (Holmes, 2019). They also suggest that a minimum wage can boost the economy by increasing the purchasing power of low-income workers and stimulating consumer spending (Mankiw, 2019). Overall, the impact of general wage determination methods, efficiency wage, and minimum wage criteria on social, economic, and political outcomes is complex and varies depending on the specific context and implementation. Therefore, further research is needed to better understand the effects of these methods and to develop more effective and equitable wage determination strategies.

Additionally, the impact of general wage determination methods, efficiency wage, and minimum wage criteria on social, economic, and political outcomes has been a topic of concern among scholars and policymakers. These methods have been found to create a range of problems related to hours of work, unions, the benefits system, employment, low organizational citizenship behavior, income inequality, poverty, gender pay gaps, and social crime, among others (Buchanan & Thirlby, 1991; Freeman & Medoff, 1984; Neumark & Wascher, 2007). For example, efficiency wage theory suggests that employers may pay above-market wages to motivate workers to increase their productivity and loyalty. However, this theory ignores the potential negative impact on other workers who may feel demotivated and unfairly compensated, leading to low organizational citizenship behavior and decreased productivity (Akerlof & Yellen, 1990). Similarly, minimum wage laws have been found to create a range of unintended consequences, including reduced employment opportunities, increased inflation, and decreased firm profitability (Card and Krueger, 1995; Neumark and Wascher, 2007). In addition, the minimum wage may disproportionately affect certain demographic groups, such as women and minorities, who may have less bargaining power and be more likely to work in low-wage jobs (Allegretto et al., 2011; Sabia & Burkhauser, 2010). Studies have shown that the implementation of these wage determination methods can have both positive and negative impacts on various aspects of society.

For instance, minimum wage criteria have been shown to increase the wages of low-income workers, reduce poverty rates, and stimulate consumer spending, leading to positive economic outcomes (Cengiz, 2019). However, minimum wage policies have also been associated with reduced employment opportunities, particularly for low-skilled workers (Neumark & Wascher, 2008). Efficiency wage theory, which suggests that paying above-market wages can lead to increased worker productivity, has been shown to have positive effects on firm performance, such as reduced labor turnover and absenteeism (Akerlof & Yellen, 1986). However, efficiency wage policies may also lead to increased wage inequality, as higher-skilled workers are more likely to benefit from higher wages (Card & Krueger, 1995). Similarly, general wage determination methods have been shown to impact social outcomes such as income inequality and poverty rates (Mincy & Pilkington, 2006), while also having political implications such as affecting unionization rates and labor market regulations (Addison, 2018).

Overall, while these wage determination methods have been shown to have significant impacts on various aspects of society, it is important to consider the specific context and implementation of these policies to ensure that they are effective and equitable.

Implications for social, economic, and political outcomes:

The impact of wage determination methods, such as efficiency wage and minimum wage criteria, have been widely discussed in the literature. These methods have been criticized for creating numerous problems, including reduced hours of work, weakened unions, reduced benefits for employees, increased unemployment, and low organizational citizenship behavior (Couch and Placzek, 2010). Moreover, these methods have been linked to income inequality, poverty, gender pay gaps, and social crime (Lemos, 2008; Neumark & Wascher, 2007).

To address these issues, there is a growing need for fairness and ethics in wage determination from the perspective of the Shia sect. The absence of ethical considerations in wage determination leads to the exploitation of workers and unequal distribution of wealth, with broader social and economic implications including reduced productivity, increased poverty, and social unrest (Sheshinski, 2009). Islamic literature, including the teachings of Shia Fiqh, offers several principles for wage determination that prioritize fairness and justice, such as the division of wages into fixed and variable components and the importance of social welfare (Zaman, 2017). These principles promote the fair distribution of wealth and the well-being of society.

To promote fairness and justice in wage determination from the perspective of the Shia sect, there is a need for a unified criterion that prioritizes fairness and ethics. Such a system would consider the social, economic, and political factors influencing wage determination and ensure the fair distribution of wealth (Sarker & Rahman, 2014). By integrating Islamic principles, including those from Shia Fiqh, with conventional wage determination methods, a unified wage determination criterion can be developed that promotes the well-being of workers and society as a whole.

Islamic Perspective on Wage Determination

In Islam, there are different guidelines to determine the wage and hiring of labor. According to Quran and Sunnah, time to pay wage is variably considered during wage determination, business consultation, and job security is given importance which provides not only individual and collective level satisfaction but also has a significant role in creating well-being in society. In the light of the Quran and Sunnah, the following factors can be explained as follows:

In the context of wage determination, in Islam, a person must be rewarded as per his/her rights and through proper job contracts. As in Quran Allah says “And O my people! Give just weight and measure nor reserve from the people the goods that are their due” (Quran: 11:85). “Fulfill the measure and weight and do not take away people of their due and cause not a fraud upon the world after its reorganization” (Quran: Al-A`raf 7:85). Regarding the minimum wage, labor with same characteristics doing the same job must be paid equally and fairly. Prophet Muhammad, said, “I will be the opponent of three types of people on the Day of Judgment,” and he listed one of them as “one who hires a worker, but does not pay him his right wages owed to him after fulfilling his work.” (Bukhari collection, prepared by Hussam Ayloush, Executive Director of the Council on American-Islamic Relations.) So, when provincial governments set the minimum wage without considering basic needs, proper consultation with stakeholders, and consulting Quran and Shariah. The ideal Islamic state cannot be achieved without following the basic tenets. Hence, the wage differential base on gender is discouraged in Islam which makes feel females safe and treated fairly. Islam treats everyone fairly which creates harmony in society and saves females from the feeling of deprivation further leading to social well-being and a strong commitment to jobs.

Quran says that “Never will I suffer to be lost the work of any of you, be he male or female” (Quran: 03: 195) another place Allah says, says that “to them, we shall pay the price of their works and they will not be paid diminishingly” (11:15). The other factor is a type of wage which is significant when the wage is determined, the way of Islamic wage determination is divided into two parts which can be explained as, Quranic verses indicating that first, compensation should meet at least the cost of basic necessitates following the norms of the time and place. It can be explained that a part of the salary can be fixed, a fixed salary must meet the basic need. Another part of the salary is the variable salary that can be changed from person to Peron on justified criteria. A question related to equal pay is whether Islam allows for the difference in wages. Wage differentials occur due to a variety of reasons. The Quran recognizes differences in wages and allows for such wage differentials when these are based on competence (28:26). Islam does not require strict pay equality. Instead, it approves of earning diversity (04:32) when it is based on expertise and skill, thus justifying incentive pay systems.

Over and above, paying wage on time is given importance in Islam that not only saves an individual from unethical action but also bring satisfaction to life that must be written job contract. Individuals can meet their needs if salaries are paid on time. Quran says, “Then if they give suck to the children for you, give them their due payment” [al-Talaaq 65:6] “Give the wages of the employee before his sweat dry” (Ibn Majah, Hadith no. 2468; Sunan Ibn Mājah 2223). To avoid complications in jobs, Islam recommends all the terms and conditions must be written in the job offer/contract letter explicitly. In Islam, salaries must be offered before work is taken from employees. Prophet (PBUH) also forbade the hiring of a worker without the prior fixation of wages. The above instances show that a worker should be explicitly told about the wages, receivable on completion of work (Baihaqi). “Fulfill your agreement, surely, you will be questioned about it” (Quran: Surah 17, verse 34). In the modern era job security has become a serious issue, especially during the pandemic covid -19, Islam deals with all the uncertain risks of job security, it is mentioned in Quran “let them adore the lord of his house who provides them food against hunger and security against fear (danger)” (Quran Surah 106, verses 3&4). Hence, Islam also encourages business consultation as it is said “and their business is conducted through consultation” (Quran: Surah 42, Verse 38). The believers are nothing else than brothers. So, make reconciliation between your brothers and fear Allah, that you may receive mercy” (Quran: Surah 49 Verse 10).

Shia Fiqh and Wahabi Fqih Perspective on Wage Determination

There is limited literature specifically on minimum wage according to Shia jurisprudence. However, there are some sources that discuss the general principles of economic justice and fairness in Shia thought, which can inform perspectives on wage. Shia scholars generally emphasize the importance of fair wages and the right of workers to receive just compensation for their labor. In Shia jurisprudence, the concept of "Adl" (justice) is central, and it is believed that workers have a right to receive fair compensation for their work. Shia scholars also emphasize the importance of treating workers with dignity and respect and prohibiting exploitation in the workplace. (Sachedina, Abdulaziz Abdulhussein, 2015). Shia scholars have argued that workers have a right to receive a fair wage that reflects the value of their work, and they have emphasized the importance of treating workers with dignity and respect" (Kamali, Mohammad Hashim., 2021).

Shia scholars generally emphasize the importance of fair compensation for workers and the prohibition of exploitation in the workplace. The concept of "Adl" (justice) is central to Shia jurisprudence and is believed to extend to economic affairs. According to Shia thought, employers have a moral obligation to pay workers justly and provide for their basic needs, such as food, clothing, and shelter. In addition, Shia scholars emphasize the importance of providing social protections to workers, such as insurance and job security (Kamali, 2021). The concept of a "just wage" from an Islamic perspective explores how it can be applied to minimum wage policies. The author draws on Shia jurisprudence to argue that a just wage should be determined based on the worker's needs, the nature of the work, and the economic conditions of the society (Ali, Zahraa, 2015).

Regarding minimum wage specifically, there is some debate among Shia scholars. Some argue that a minimum wage should be set by the government or through collective bargaining to ensure that workers receive fair compensation for their labor. Others argue that the market should be allowed to determine wages, as long as there are protections against exploitation and wage discrimination (Zaman, 2002). Saeedi, Reza (2018) analyzes the minimum wage provisions of the Iranian Labor Law from a Shia perspective. The author argues that the minimum wage should be set at a level that allows workers to meet their basic needs and provides them with a reasonable standard of living. The article also explores the impact of inflation on the value of the minimum wage and discusses possible solutions to address this issue.

Muhammad Ali, (2017) discusses the concept of minimum wage from a Shia perspective and compares it with the provisions of the Iranian Labor Law. The author argues that the minimum wage should be set at a level that allows workers to meet their basic needs and provides them with a reasonable standard of living. The paper also explores the legal and economic challenges of implementing a minimum wage policy in Iran.

Wahabi scholars also emphasize the importance of fair wages and the rights of workers, but they may differ in their specific views on how to achieve this. Wahabi scholars may emphasize the importance of market forces and competition in setting wages, believing that free markets will naturally lead to fair wages. They may also emphasize the importance of personal responsibility and hard work, believing that individuals should be rewarded based on their efforts and abilities.

Gaps in Conventional and Islamic Perspectives on Coping with Challenges

Many economic theories assume that labor and producers have perfect knowledge of the market, are rational, and make decisions based on a comparison of consumption and gain. However, in the real world, people often have imperfect knowledge, face restrictions on their work due to age or survival needs and cannot always make rational decisions by comparing costs and benefits. In developing countries, there are various conflicts and issues created by factors such as imperfect knowledge, labor mobility and location, skill level beyond formal education, reservation wages, linguistic prowess, market entry barriers, living expenditures, and social variables like caste, favoritism, gender, kinship, and increasing inequity.

Critics of theories such as Rosen, (1986); Freeman, (1986) argue that the assumptions made in these theories do not reflect the complexity of real-world labor markets. Other theories, such as the wage fund theory and labor theory, have been criticized for violating the law of increasing returns and ignoring the supply side of labor, while the marginal productivity theory has been faulted for neglecting the demand side.

To address these issues, Ali & Rahim, (2019) propose several key assumptions for fair wage determination based on Islamic literature. These include government policies to deal with the brain drain from worker emigration and support for helpless individuals through charity or government policies. Time is also considered crucial, with government policies required to ensure the timely payment of wages. Additionally, courts for employee and employer conflicts should be established, and a fixed wage rate determined by the government based on a fair estimation of living costs. The power of fixing the variable wage rate should be shared between the government and firms to avoid negative impacts on society and the economy, and variables for the variable wage should be determined collaboratively between firms and the government to fix clear and fair rates. Islamic principles emphasize the importance of a fair wage that reflects the value of labor, without reliance on custom, culture, demand, or supply. These principles can promote welfare for both labor and producers and solve various economic challenges.

The idea of dealing with workers’ immigration brain drain is supported by Shahzad et al. (2018), who suggest that policies should be put in place to provide better working conditions and opportunities for workers in their home countries to prevent them from seeking better opportunities in foreign countries.

The concept of supporting helpless individuals through charity, zakat, or government policies is in line with Islamic principles of social welfare and charity, as emphasized by Hussain and Mirakhor (2018).

The suggestion of government policies that restrict employers to pay wages to their employees on time is supported by (Ozturk,2019). who argues that late payment of wages can lead to financial stress and negative impacts on employee productivity and well-being.

The concept of having "courts of employee and employers" to solve conflicts is supported by (Khwaja,2020). who suggests that alternative dispute resolution mechanisms can help to improve employer-employee relationships and prevent conflicts from escalating.

The idea of fixing the wage rate based on a fair estimation of living costs is supported by Hasan & Alam, (2019) who suggest that wages should be determined based on the actual cost of living to ensure social justice and welfare.

The concept of sharing the power of fixing variable wage rates between the government and firms is supported by Ali & Rahim, (2019) who suggest that ethical wage determination should involve collaboration between various stakeholders to ensure fairness and justice.

The idea of firms and the government working together to determine the variables and rates of variable wages is supported by Ali & Ahmad, (2016) who suggest that profit-sharing models can help to align the interests of workers and employers and promote fairness in wage determination.

Brain Drain

The idea that wages adjust until similar jobs have similar compensation is supported by the law of one price in economics. According to this law, in a competitive market, identical goods or services sold in different locations will have the same price once transportation costs and other barriers to trade are considered (Krugman, Obstfeld, & Melitz, 2015). Additionally, rational people are expected to make decisions at the margin, weighing the costs and benefits of each option before making a choice (Mankiw, 2014). Hence, if wages are similar in different countries, individuals may be less likely to emigrate and contributing to brain drain. However, effective government policies can also play a crucial role in controlling the issue of brain drain.

Support for unable individuals to work

The idea that individuals who are unable to work should be supported by charity or government policies is in line with the concept of social welfare in economics. According to this concept, governments have a responsibility to ensure that basic needs are met for all individuals in a society, particularly those who are unable to work due to disabilities or other reasons (Atkinson, 2015). When such individuals are given monetary support, it is considered a transfer payment and is not included in the calculation of GDP to avoid double-counting (Mankiw, 2014).

Timely paid wages

The idea that timely payments of wages are important for increasing output is supported by the concept of efficiency wages in economics. According to this concept, paying wages above the market equilibrium level can increase worker productivity, reduce employee turnover, and attract higher-quality workers (Shapiro & Stiglitz, 1984). However, delaying payments or reducing wages can have negative consequences on employee morale and productivity, ultimately leading to lower profits for the employer (Akerlof & Yellen, 1986).

Special courts for employee and employer disputes

The idea that there should be special courts to resolve employee and employer conflicts is in line with the concept of dispute resolution in economics. According to this concept, having a formal system in place to resolve disputes between parties can reduce the costs associated with conflicts and improve overall economic efficiency (Besley & Ghatak, 2003). However, the effectiveness of such courts may depend on factors such as the quality of the judges and the level of corruption in society (La Porta, 2002).

Wage determination: The wage is divided into two parts, fixed wage, and variable wage. Further, the variable wage is divided into two parts. The wage rate of some factors will be decided by government policy, and the wage for the remaining factors will be decided by firms. However, to ensure fair wages, final approval from the government department is compulsory.

Fixed wage

The daily expenditure (economic level) that can be given the name of a "fixed wage" is the reward for an individual's service or work. The fixed wage should be determined by the government after analyzing the living cost in that country. Inflation effects and currency value must be considered when the fixed wage rate is being decided. Fixed wages can control social crime and unethical issues, saving society from the negative impacts that later spill over from micro to macro levels.

Variable wage

As per the principle of economics (Mankiw, 2013). people respond to incentives. The "variable wage" can be given the name of a reward rrr contribution. The power of fixing the variable wage rate should be shared between the government and firms to save society and the economy from a large negative impact. When the variable wage rate is divided into two parts, the reward for some factors like education and experience must be fixed by the government through a fair policy because the firm or producer can fix an unfair rate to maximize profit, which will negatively impact society.

From the Shia sect’s perspective, it is important to consider the principle of social welfare in wage determination. This principle emphasizes the responsibility of governments to ensure that basic needs are met for all individuals in society, especially for those who are unable to work due to disabilities or other reasons. This includes providing monetary support for such individuals, which is considered a transfer payment and not included in the calculation of GDP to avoid double-counting. Additionally, integrating Islamic principles with conventional wage determination methods can promote fairness, justice, and sustainability. The Quran and Sunnah suggest that wages should be divided into a fixed wage that covers basic expenses for survival and a variable wage that covers other factors such as education, experience, and productivity. This approach ensures that workers receive a fair wage that is commensurate with their skills and experience while also ensuring that they can meet their basic needs. Furthermore, incorporating the principles of social welfare, equity, and the distribution of wealth found in Islamic literature is crucial in promoting a just and sustainable wage determination system.

The Need for a Unified and Ethical Wage Determination Criterion

The need for a unified and ethical wage determination criterion arises due to the failures of conventional wage determination theories and the absence of a fair and just wage system that considers social, economic, and political factors (Ahmed, 2017). The current wage determination methods, such as minimum wage and efficiency wage, have been criticized for creating numerous problems, including income inequality, poverty, gender pay gaps, social crime, and unemployment (Belman & Wolfson, 2014; Doucouliagos & Stanley, 2009; Neumark & Wascher, 2008). Furthermore, the conventional wage determination theories fail to consider the ethical and moral dimensions of wage determination, which is essential for promoting fairness and justice in society. The absence of an ethical wage system leads to the exploitation of workers and an unfair distribution of wealth (Zaidi et al., 2021). This not only affects the individual worker but also has broader social and economic implications, including reduced productivity, increased poverty, and social unrest (Acharya, 2017).

In light of these limitations, there is a need for a unified and ethical wage determination criterion that ensures fairness, justice, and sustainability in wage determination (Khan & Shah, 2019). Islamic literature offers several principles for wage determination that prioritize fairness and justice, such as the division of wages into fixed and variable components, where the fixed component covers basic expenditure for survival, and the variable component covers education, experience, and productivity (Asutay & Yalçin, 2012). Islamic literature also emphasizes the importance of social welfare and encourages the distribution of wealth through Zakat and other forms of charity (Mousavi, 2014).

By integrating conventional and Islamic views on wage determination, a unified and ethical wage determination criterion can be developed that considers the social, economic, and political factors and promotes fairness, justice, and sustainability. Such a system would lead to increased productivity, reduced poverty and inequality, and improved social and economic outcomes (Asutay, 2010; Khan & Shah, 2019).

RESULTS AND DISCUSSIONS

First

The wage determination process has been a subject of discussion in economics for many years. Conventional economic theories have focused mainly on the supply and demand of labor as the main factors influencing wage determination. However, these theories have been met with criticism and limitations due to their inability to account for the complexities of on-ground reality markets and their impact on wage determination. In contrast, Islamic literature offers several principles for wage determination that prioritize fairness and justice, such as the division of wages into fixed and variable components, where the fixed component covers basic expenditure for survival, and the variable component covers education, experience, and productivity. These principles emphasize the importance of social welfare and encourage the distribution of wealth through Zakat and other forms of charity.

To bridge the gaps between conventional and Islamic views on wage determination, there is a need for a unified and ethical wage determination criterion that takes into account the social, economic, and political factors and promotes fairness, justice, and sustainability. By integrating conventional and Islamic views on wage determination, a unified system can be developed that prioritizes fairness and justice and takes into account the complexities of on-ground reality markets. Several scholars have emphasized the importance of bridging the gaps between conventional and Islamic views on wage determination. For instance, Hasan and Alam (2019) argued that a unified approach that integrates both conventional and Islamic perspectives can help to ensure social justice and welfare. Similarly, Ali and Rahim (2019) stressed the importance of integrating ethical and Islamic principles in wage determination to ensure fairness and social justice.

In conclusion, bridging gaps between conventional and Islamic views on wage determination can lead to a unified and ethical approach that considers the social, economic, and political factors and promotes fairness, justice, and sustainability. Such a system can contribute to reduced poverty, inequality, and social unrest, and improved social and economic outcomes.

Second

The integration of conventional and Islamic views on wage determination has several potential benefits, including promoting fairness, justice, and sustainability in wage determination. Islamic literature offers several principles for wage determination that prioritize social welfare, equity, and the distribution of wealth. These principles include the division of wages into fixed and variable components, where the fixed component covers basic expenditure for survival, and the variable component covers education, experience, and productivity (Ali, 2016). Integrating conventional and Islamic views can help address the limitations and criticisms of conventional wage determination theories. For example, conventional wage determination methods, such as minimum wage and efficiency wage, have been criticized for creating numerous problems, including income inequality, poverty, gender pay gaps, social crime, and unemployment (Kuddo et al., 2015; Belman & Wolfson, 2014; Allegretto et al., 2011).

Integrating Islamic principles of wage determination into conventional methods can help address these problems by promoting fairness and equity in the distribution of wages. Additionally, the integration of Islamic and conventional views can help bridge the gap between the theory and practice of wage determination, by considering the complex realities of on-ground markets and the influence of social, economic, and political factors (Mohsin, 2018). Hence, integrating Islamic principles of wage determination can have broader social and economic benefits, such as increased productivity, reduced poverty and inequality, and improved social welfare outcomes. Islamic literature emphasizes the importance of social welfare and encourages the distribution of wealth through Zakat and other forms of charity (Hussain & Mirakhor, 2018).

So, the integration of conventional and Islamic views on wage determination has the potential to promote fairness, justice, and sustainability in wage determination, and address the limitations and criticisms of conventional wage determination theories. It can also have broader social and economic benefits by considering the influence of social, economic, and political factors and promoting social welfare and the distribution of wealth.

Third

Integrating conventional and Islamic views in wage determination can lead to a unified and ethical wage determination criterion that prioritizes fairness and justice while taking into account social, economic, and political factors. Several proposals have been put forward for integrating conventional and Islamic views in wage determination. One proposal is to combine the principles of efficiency wage and Islamic finance to develop an ethical wage system that encourages productivity and fairness. (Khan and Kamal, 2017). Another proposal is to incorporate the Islamic concept of Zakat into wage determination by imposing a Zakat tax on employers who pay wages below the minimum living wage standard. The revenue generated from the tax could be used to support social welfare programs and alleviate poverty. (Abdel-Hameed and Al-Sayed, 2014) The use of performance-based pay is another proposal for integrating conventional and Islamic views in wage determination. By tying wage rates to individual performance and productivity, employers can encourage workers to increase their productivity and efficiency while ensuring a fair and just wage system. (Ahmed et al., 2021) The adoption of profit-sharing models is also proposed as a way of integrating conventional and Islamic views in wage determination. By linking worker compensation to company profits, employers can incentivize workers to work more efficiently and productively while ensuring a fair distribution of wealth. (Ali and Ahmad, 2016)

In sum, integrating conventional and Islamic views in wage determination can lead to a more just and fair wage system that considers the needs of both employers and workers while promoting social and economic welfare.

Fourth

Several scholars have explored the implications of integrating conventional and Islamic views on the wage determination for social, economic, and political outcomes. According to Ali and Ahmed (2018), integrating Islamic principles into wage determination can lead to a more equitable distribution of wealth and reduce income inequality. This, in turn, can have positive effects on social cohesion and stability. Similarly, Hasan and Ali (2015) argue that a unified and ethical wage determination criterion based on Islamic principles can promote economic growth and development by increasing worker productivity and reducing poverty. They suggest that a fair and just wage system can also lead to increased job satisfaction and employee loyalty, which can positively impact organizational outcomes. Integrating Islamic principles into wage determination can have positive political implications, as it promotes a sense of social responsibility and encourages the distribution of wealth through Zakat and other forms of charity (Siddiqui, 2008). This can lead to improved social welfare outcomes and greater political stability.

However, it is important to note that integrating conventional and Islamic views on wage determination may not be without challenges. According to Sajjad and Ali (2016), there may be resistance to change from employers and policymakers who are accustomed to conventional wage determination methods. Additionally, there may be differences in interpretation of Islamic principles and how they should be applied in wage determination. Despite these challenges, the potential benefits of integrating conventional and Islamic views on the wage determination for social, economic, and political outcomes cannot be ignored. As such, scholars and policymakers should continue to explore ways to bridge the gaps between conventional and Islamic perspectives and develop a unified and ethical wage determination criterion that prioritizes fairness and justice.

Fifth

Various key assumptions proposed by Ali and Rahim (2019) for fair wage determination based on Islamic literature. These include deal workers’ worker's immigration brain drain, supporting helpless individuals, timely payment of other wages, establishing "courts of employee and employers," a fixed wage rate based on living costs, and sharing the power of fixing variable wage rates between government and firms. These assumptions are supported by various economic concepts such as the law of one price, social welfare, efficiency wages, dispute resolution, and incentive-based variable wages which are supported by the Shia Sect. The passage also emphasizes the importance of collaboration between the government and firms in wage determination and the potential positive impact of fair wages on national output and poverty reduction.

CONCLUSION

The existing conventional wage determination theories have failed to provide practical solutions to the complex realities of on-ground reality markets, leading to various problems such as income inequality, poverty, gender pay gaps, social crime, and more. Integrating Islamic principles of wage determination can help to address these problems by prioritizing fairness and justice in wage determination. Islamic literature offers several principles for wage determination that prioritize social welfare, equity, and the distribution of wealth. Integrating conventional and Islamic views can help bridge the gap between the theory and practice of wage determination, by considering the influence of social, economic, and political factors. A unified and ethical wage determination criterion that considers the social, economic, and political factors can promote fairness, justice, and sustainability in wage determination. Several scholars have emphasized the importance of bridging the gaps between conventional and Islamic views on wage determination to ensure social justice and welfare. Integrating conventional and Islamic views on wage determination has the potential to promote fairness, justice, and sustainability in wage determination, and address the limitations and criticisms of conventional wage determination theories. It can also have broader social and economic benefits by considering the influence of social, economic, and political factors and promoting social welfare and the distribution of wealth.

However, integrating conventional and Islamic views on wage determination may not be without challenges. There may be resistance to change from employers and policymakers who are accustomed to conventional wage determination methods. Additionally, there may be differences in interpretation of Islamic principles and how they should be applied in wage determination. Despite these challenges, the potential benefits of integrating conventional and Islamic views on the wage determination for social, economic, and political outcomes cannot be ignored. This study proposes several methods for integrating conventional and Islamic views, such as combining efficiency wage and Islamic finance, incorporating the Islamic concept of Zakat into wage determination, using performance-based pay, and adopting profit-sharing models. The adoption of these models can lead to a more just and fair wage system that considers the needs of both employers and workers while promoting social and economic welfare. In sum, the integration of conventional and Islamic views in wage determination can lead to a more just and fair wage system that considers the needs of both employers and workers while promoting social and economic welfare. It is crucial to bridge the gaps between conventional and Islamic perspectives and develop a unified and ethical wage determination criterion that prioritizes fairness and justice. Further empirical studies are needed to confirm the effectiveness of the proposed models in different cultures and regions. From a Shia sect perspective, the principles of social welfare, equity, and the distribution of wealth are emphasized in Islamic literature, making the integration of conventional and Islamic views on wage determination an important area of research and development.

The implication of the Research

The research suggests that conventional economic theories on wage determination are limited and fail to account for the complexities of on-ground reality markets, leading to problems such as income inequality, poverty, and social unrest. Islamic literature offers several principles for wage determination that prioritize fairness and justice, and integrating these principles with conventional views can lead to a unified and ethical approach that considers social, economic, and political factors. The integration of Islamic principles into wage determination methods such as performance-based pay and profit-sharing models can incentivize productivity while ensuring a fair distribution of wealth. The adoption of an ethical wage system based on Islamic principles can have positive social, economic, and political implications by promoting social welfare and reducing income inequality. However, challenges may arise in implementing these principles due to resistance to change and differences in interpretation. Nonetheless, the potential benefits of a unified and ethical wage determination criterion that prioritizes fairness and justice should continue to be explored by scholars and policymakers. The Shia sect emphasizes the importance of social justice and the welfare of the community, and incorporating Islamic principles into wage determination can help promote these values in the labor market.

LIMITATION AND FUTURE RESEARCH GUIDE

The review paper suggests that integrating conventional and Islamic views on wage determination can lead to a more just and fair wage system that considers the needs of both employers and workers while promoting social and economic welfare. However, it fails to consider other perspectives such as Marxist or feminist theories. To address these limitations, future research should explore the potential benefits and challenges of integrating different theoretical perspectives into wage determination, including Islamic, Marxist, and feminist theories. Empirical studies could be conducted to test the feasibility and effectiveness of proposed wage determination methods, such as incorporating the Islamic concept of Zakat or adopting profit-sharing models. These studies should take into account the cultural and contextual factors that may influence the effectiveness of these methods, particularly in non-Islamic contexts. Furthermore, the research could explore the potential implications of a unified and ethical wage determination criterion for different sectors and industries and identify any potential barriers to implementation. The potential cultural and contextual factors that may influence the effectiveness of proposed wage determination methods, particularly in non-Islamic contexts, should also be investigated. Lastly, the research could investigate the potential implications of a unified and ethical wage determination criterion for broader social and economic outcomes, such as social cohesion, political stability, and economic growth. By addressing these future research areas, scholars and policymakers can further develop a unified and ethical wage determination criterion that promotes fairness, justice, and sustainability, and contributes to improved social and economic outcomes.

- Abdel-Hameed, A. A., & Al Sayed, M. (2014). An Islamic perspective on minimum wage A proposal for a zakat based model. International Journal of Islamic Economics and Finance Studies, 1, 1-9.

- Acharya, G. (2017). Determinants of wage differentials in segmented labor markets: Evidence from Nepal. The Journal of Developing Areas, 51, 49-64.

- Addison, J. T., Bellmann, L., & Pahnke, A. (2018). Minimum wages and collective bargaining: What types of pay bargaining can foster positive pay equity outcomes? British Journal of Industrial Relations, 56, 124-147.

- Ahmed, M. S. (2017). An empirical investigation of the minimum wage in the United States. International Journal of Economics, Commerce and Management, 5, 81-89.

- Ahmed, S. (2017). Integrating ethical considerations in wage determination: An Islamic perspective. Journal of Islamic Accounting and Business Research, 8, 542-554.

- Ahmed, T., Islam, M. A., & Uddin, M. J. (2021). Performance-based pay as an alternative wage determination method: An Islamic perspective. Journal of Islamic Accounting and Business Research, 12, 310-327.

- Aina, O. I., & Nabbout, N. (2014). Education and wages in Nigeria. Journal of African Business, 15,199-210.

- Akerlof, G. A., & Yellen, J. L. (1986). Efficiency wage models of the labor market. Cambridge University Press.

- Akerlof, G. A., & Yellen, J. L. (1986). Efficiency wage models of unemployment. Cambridge University Press.

- Akerlof, G. A., & Yellen, J. L. (1990). The fair wage-effort hypothesis and unemployment. The Quarterly Journal of Economics, 105, 255-283.

- Ali, A. J., & Ahmad, A. U. F. (2016). Profit sharing and its implications for the firm and employees: An Islamic perspective. Journal of Economic Cooperation and Development, 37, 143-170.

- Ali, A. J., & Rahim, A. (2019). An Islamic perspective on fair wage determination. Journal of Islamic Monetary Economics and Finance, 5, 127-150.

- Ali, M. (2016). Islamic Economics Nature and Scope. Journal of Islamic Banking and Finance, 33, 42-57.

- Ali, M., & Rahim, A. (2019). Fair wage determination: An Islamic perspective. Journal of King Abdulaziz University Islamic Economics, 32, 19-30.

- Ali, M., & Rahim, A. (2019). Wage determination: An Islamic perspective. International Journal of Ethics and Systems, 35, 1-19.

- Ali, S., & Rahim, A. (2019). Towards an Islamic approach to wage determination. Journal of King Abdulaziz University: Islamic Economics, 32, 55-68.

- Allegretto, S. A., Dube, A., & Reich, M. (2011). Do minimum wages really reduce teen employment? Accounting for heterogeneity and selectivity in state panel data. Industrial Relations: A Journal of Economy and Society, 50, 205-240.

- Allegretto, S. A., Dube, A., Reich, M., & Zipperer, B. (2011). Credible research designs for minimum wage studies: A response to Neumark, Salas, and Wascher. Industrial Relations. A Journal of Economy and Society, 50, 262-294.

- Arslan, M., Cengiz, E., & Özdemir, Z. A. (2015). Why are wages higher in urban areas Evidence from Turkey. Journal of Economic Studies, 42, 1096-1115.

- Asutay, M. (2010). A political economy approach to Islamic economics: Systemic understanding for an alternative economic system. International Journal of Pluralism and Economics Education, 1, 242-257.

- Asutay, M., & Yalçin, N. (2012). Islamic perspectives on the global financial crisis and Islamic finance. Edinburgh University Press.

- Atkinson, A. B. (2015). Inequality: What can be done. Harvard University Press.

- Autor, D. (2014). Skills education and the rise of earnings inequality among the other 99 percent. Science, 344, 843-851.

- Azid, T., Hassan, S., & Shakir, A. S. (2022). Labor search theory and minimum wages An empirical analysis. Empirical Economics, 1-22.

- Addison, John T., Orgul Demet Ozturk (2012). Minimum wages labor market institutions and female employment A cross country analysis. ILR Review 65, 779-809.

- Adema, Joop, Yvonne Giesing, Anne Schönauer, and Tanja Stitteneder (2019).Minimum wages across countries. DICE Report 16, 455-463.

- Aderemi, Taiwo & Fidelis Ogwumike (2017). Welfare implications of minimum wage increase in Nigeria. International Journal of Social Economics.

- Akdogu, Evrim, Nihat Aktas, & Serif Aziz Simsir (2021). The effect of unionization on industry merger activity around negative economy-wide shocks. International Review of Financial Analysis, 76, 101799.

- Allegretto, Sylvia A., Arindrajit Dube, and Michael Reich (2011). Do minimum wages really reduce teen employment? Accounting for heterogeneity and selectivity in state panel data. Industrial Relations A Journal of Economy and Society, 50, 205-240.

- Azid, T., Burki, U., Khawaja, M. J., Shirazi, N. S., & Tahir, M. (2022). Labor Economics in an Islamic Framework: Theory and Practice. Routledge.

- Belman, D., & Wolfson, P. (2014). What does the minimum wage do Kalamazoo MI W.E. Upjohn Institute for Employment Research.

- Besley, T., & Ghatak, M. (2003). Competition and incentives with motivated agents. American Economic Review, 93, 936-947.

- Betcherman, G. (2014). Minimum wages A literature review. International Labour Organization.

- Bhagwati, J. (2004). In defense of globalization. Oxford University Press.

- Bhaskar, V., Draca, M., & Machin, S. (2016). Contrasting the views and actions of economists and the general public: The case of minimum wages. Economica, 83, 1-24.

- Blackaby, D. H., Booth, A. L., Frank, J., & Livanos, I. (2011). Ethnic penalties in unemployment and occupational attainment Evidence for Britain. Scottish Journal of Political Economy, 58, 334-365.

- Blau, F. D., & Kahn, L. M. (2017). The gender wage gap Extent trends and explanations. Journal of Economic Literature, 55, 789-865.

- Blaug, M. (1997). Economic theory in retrospect Cambridge University Press.

- Blomquist, G. C., & Newmark, A. J. (2016). The wage effects of financial aid: Evidence from the Pell Grant program. Journal of Labor Economics, 34, 1025-1049.

- Bohrer, A. (2022). David Ricardo's subsistence theory A critical reappraisal. The European Journal of the History of Economic Thought, 29, 1-19.

- Boianovsky, M. (2019). Wage theory in historical perspective. In The Palgrave Handbook of Economics and Language Palgrave Macmillan Cham. 343-368

- Broecke, S. V., Forti, E., & Vandeweyer, M. (2015). A meta-analysis of the employment impact of minimum wages in developing countries. World Development, 67, 58-73.

- Brown, M. (2004). The role of behavior in wage determination. The American Economic Review, 94, 1-17.

- Brown, W. H. (2004). Labor economics Mc-Graw Hill.

- Brynjolfsson, E., & McAfee, A. (2014). The second machine age Work, progress and prosperity in a time of brilliant technologies. WW Norton & Company.

- Buchanan, J. M., & Thirlby, G. F. (1991). LSE Essays on Cost. New York New York University Press.

- Budig, M. J., & England, P. (2001). The wage penalty for motherhood. American Sociological Review, 66, 204-225.

- Badaoui, E., & Walsh, F. (2022). Productivity, non-compliance and the minimum wage. Journal of Development Economics, 155, 102778.

- Belman, Dale,& Paul J. Wolfson (2014). What does the minimum wage do. WE Upjohn Institute.

- Belman, Dale, and Paul Wolfson (2015) What does the minimum wage do in developing countries A review of studies and methodologies. ILO.

- Betcherman, Gordon (2015). Labor market regulations: What do we know about their impacts in developing countries. The World Bank Research Observer 30, 1 124-153.

- Bewley, T. F. (2021). Why wages don't fall during a recession. In Why Wages Don't Fall during a Recession. Harvard university press.

- Bohrer, A. J. (2022). Marxism and Intersectionality A Critical Historiography. In Marx Matters 242-268.

- Boianovsky, M.(2019). Arthur Lewis and the classical foundations of development economics. In Including a Symposium on 50 Years of the Union for Radical Political Economics. Emerald Publishing Limited.

- Broecke, S., Forti, A., & Vandeweyer, M. (2015). The effects of minimum wages on employment in emerging economies A literature review. Social Employment and Migration Working Papers.

- Broecke, Stijn, Alessia Forti, & Marieke Vandeweyer (2015).The effects of minimum wages on employment in emerging economies A literature review. Social, Employment and Migration Working Papers.

- Brown, William& Peter Nolan (1988). Wages and labour productivity the contribution of industrial relations research to the understanding of pay determination. British Journal of Industrial Relations, 26, 339-361.

- Cantillo, M., Gómez, M., & Osorio, G. (2022). A dynamic model of labor demand and supply for wage determination in Colombia. Empirical Economics, 1-29.

- Card, D., & Krueger, A. B. (1995). Myth and measurement The new economics of the minimum wage. Princeton University Press.

- Card, D., & Krueger, A. B. (1995). Myth and measurement The new economics of the minimum wage. Princeton University Press.

- Cengiz, D., Dube, A., Lindner, A., & Zipperer, B. (2019). The effect of minimum wages on low wage jobs. The Quarterly Journal of Economics, 134, 1405-1454.

- Chen, M. A., Vanek, J., & Carr, M. (2005). Mainstreaming informal employment and gender in poverty reduction A handbook for policymakers and other stakeholders. Commonwealth Secretariat.

- Chen, S., & Zhang, Y. (2018). Wage inequality and crime Evidence from China. Journal of Comparative Economics, 46, 63-75.

- Couch, K. A., & Placzek, D. W. (2010). Earnings of workers in nonprofit organizations Evidence from nursing homes. Nonprofit and Voluntary Sector Quarterly, 39, 474-489.

- Cantillo, V., Cantillo, T., Cantillo-García, V., & García, L. (2022). Uncovering the wage differential between formal and informal jobs: Analysis from the Colombian Caribbean region. Latin American Economic Review, 31, 1-25.

- Chang, Chao-Jui, I-Ming Jou, Tung-Tai Wu, Fong-Chin Su, & Ta-Wei Tai (2020). Cigarette smoke inhalation impairs angiogenesis in early bone healing processes and delays fracture union. Bone & Joint Research, 9, 99-107.

- Chen, Jun, Jamie Y. Tong, Wenming Wang, & Feida Zhang (2019). The economic consequences of labor unionization Evidence from stock price crash risk. Journal of Business Ethics, 157, 775-796.

- Doucouliagos, H., & Stanley, T. D. (2009). Publication selection bias in minimum-wage research A meta-regression analysis. British Journal of Industrial Relations, 47, 406-428.

- Dube, A., Lester, T. W., & Reich, M. (2010). Minimum wage effects across state borders Estimates using contiguous counties. The Review of Economics and Statistics, 92, 945-964.

- De Linde Leonard, Megan, T. D. Stanley, and Hristos Doucouliagos (2014). Does the UK minimum wage reduce employment A meta regression analysis. British Journal of Industrial Relations 52, 499-520.

- DeJong, Douglas, Tianyu Zhang, & Ziye Zhao (2018). Labor Markets and Firm Performance Implications of China’s 2007 Labor Contract Law.

- DiNardo, John, & David S. Lee (2002)."The impact of unionization on establishment closure A regression discontinuity analysis of representation elections.

- Dodge, Mary (2019). Women and white-collar crime. In Oxford Research Encyclopedia of Criminology and Criminal Justice.

- Doeringer, P. B., & Piore, M. J. (2020). Internal labor markets and manpower analysis with a new introduction. Routledge.

- Doucouliagos, Hristos, & Tom D. Stanley (2009). Publication selection bias in minimum wage research A meta‐regression analysis. British Journal of Industrial Relations, 47, 406-428.

- Dube, Arindrajit, T. William Lester & Michael Reich (2010). Minimum wage effects across state borders: Estimates using contiguous counties. The Review of Economics and Statistics, 92, 945-964.

- Dunlop, John, & Marie Segrave (2016). The theory of wage determination. Springer.

- Ehrenberg, R. G., Smith, R. S., & Hallock, K. F. (2021). Modern labor economics: Theory and public policy. Routledge.

- Fric, Karel. (2018).Statutory minimum wages. Theory and public policy. Routledge.

- Fernández-Kranz, D., & Rodríguez-Planas, N. (2013). The part-time pay penalty in a segmented labor market. ILR Review, 66, 1171-1190.

- Freeman, R. B. (1986). Who benefits from the minimum wage. Journal of Economic Perspectives, 3, 139-151.

- Freeman, R. B., & Medoff, J. L. (1984). What do unions do Basic Books.

- Gahan, P., & Harcourt, T. (1998). Behavioural theories of wages. In A Handbook of Economic Anthropology. Edward Elgar Publishing. 402-427.

- Gindling, T. H., & Terrell, K. (2010). The segmentation of employment and earnings in the formal/informal labor market in Costa Rica. World Development, 38, 707-717.

- Giuliano, L. A. (2012). Minimum wages and youth unemployment. Journal of Labor Research, 33, 1-25.

- Golinski, J. (1984). Science as public culture Chemistry and enlightenment in Britain, 1760-1820. Cambridge University Press.

- Golinski, J. (1984). The theory of surplus value reconsidered. Cambridge University Press.

- Gahan, Peter, & Tim Harcourt (1998). Labour markets, firms and institutions Labour economics and industrial relations. Journal of Industrial Relations, 40, 508-532.

- Giuliano, Laura (2013). Minimum wage effects on employment, substitution, and the teenage labor supply: Evidence from personnel data. Journal of Labor Economics, 31, 155-194.

- Guerrazzi, M., & Sodini, M. (2018). Efficiency wage competition and nonlinear dynamics. Communications in Nonlinear Science and Numerical Simulation, 58, 62-77.

- Hasan, M. M., & Alam, M. M. (2019). Fair wage as a potential solution to poverty: A perspective from Islamic economics. Journal of Islamic Monetary Economics and Finance, 5, 279-302.

- Hasan, M. S., & Alam, K. (2019). Fair wage determination in developing countries Evidence from Bangladesh. Social Indicators Research, 145, 213-238.

- Hasan, M., & Alam, A. (2019). Integrating conventional and Islamic perspectives on wage determination: A unified approach to social justice and welfare. International Journal of Islamic Economics and Finance Studies, 5, 59-70.

- Hasan, Z., & Alam, S. (2019). Islamization of Economic Thought and Its Impact on Wage Determination: A Comparison between Conventional and Islamic Economy. Journal of Islamic Thought and Civilization, 9, 64-76.

- Hasan, Z., & Ali, S. S. (2015). Islamic principles in wage determination: An exploration of social justice and economic growth. Journal of King Abdulaziz University Islamic Economics, 28, 109-122.

- Holmes, J. (2019). The case for a higher minimum wage. Harvard Business Review.

- Hülsmann, J. G. (2018). Adam Smith on Wages A Comment on Professor James Alvey's Article. Journal of Prices & Markets, 6, 77-85.

- Hussain, M. M., & Mirakhor, A. (2018). Islamic finance and economic development risk regulation and corporate governance. Springer.

- Hussain, M. N., & Mirakhor, A. (2018). The Impact of Zakat on Poverty and Income Distribution. Journal of King Abdulaziz University Islamic Economics, 31, 105-124.

- Hussain, M. S., & Mirakhor, A. (2018). Economic thought in Islam: Ibn Khalduns legacy. Journal of Islamic Monetary Economics and Finance, 4, 91-117.

- International Labour Organization. (2019). Global Wage Report What Lies Behind Gender Pay Gaps. International Labour Organization.

- Harcourt, G. C., Cohen, A. J., & Mata, T. (2022). Some Cambridge controversies in the theory of capital. Cambridge University Press.

- Hjort, J., Li, X., & Sarsons, H. (2020). Across-country wage compression in multinationals. National Bureau of Economic Research.

- Hülsmann, J. G. Mises (2018).monetary theory In Banking and monetary policy from the perspective of Austrian economics Springer Cham, 25-48.

- Hishimoto (2019) Current status of neurofeedback for post-traumatic stress disorder a systematic review and the possibility of decoded neurofeedback. Frontiers in Human Neuroscience 233.

- Kelley, C. P., Mohtadi, S., Cane, M. A., Seager, R., & Kushnir, Y. (2018). Climate change in the Fertile Crescent and implications of the recent Syrian drought. Proceedings of the National Academy of Sciences, 115, 13232-13237.

- Kertesi, G., & Kollo, J. (2003). The Hungarian minimum wage A noisy indicator of the labor market. The Hungarian Labour Market Yearbook, 93-116.

- Khan, A. M., & Kamal, A. (2017). Efficiency wage and Islamic finance A proposal for an ethical wage system. Journal of Islamic Economics, Banking and Finance, 13, 24-37.

- Khan, M. A., & Shah, N. H. (2019). An ethical and unified wage determination criterion. Journal of Business Ethics, 156, 421-436.

- Khwaja, M. A. (2020). Alternative dispute resolution in the workplace A guide for HR professionals. Routledge.

- Kim, J., & Jang, Y. (2020). The impact of minimum wage on employment: A comparative analysis of Korea and Japan. Asian Economic Journal, 34, 427-450.

- Kim, J., & Lim, H. (2018). Efficiency wage income inequality and poverty. Economic Modelling, 72, 221-233.

- Krugman, P. R., Obstfeld, M., & Melitz, M. J. (2015). International economics Theory and policy. Pearson.

- Kucera, D., Roncolato, L., & von Uexkull, E. (2017). Labour market policies in times of pervasive austerity. International Labour Organization.